Incognito is part of eth ecosystem. Listed ads here https://etherscan.io/tokens is one option to consider.

Why not cmc?.

Because almost of big project are sponsored on etherscan within the long period And that is targeted user. Incognito require marketing. CMC is to general user.

Good product without nobody know is like the hidden gold.

No customer no purchases

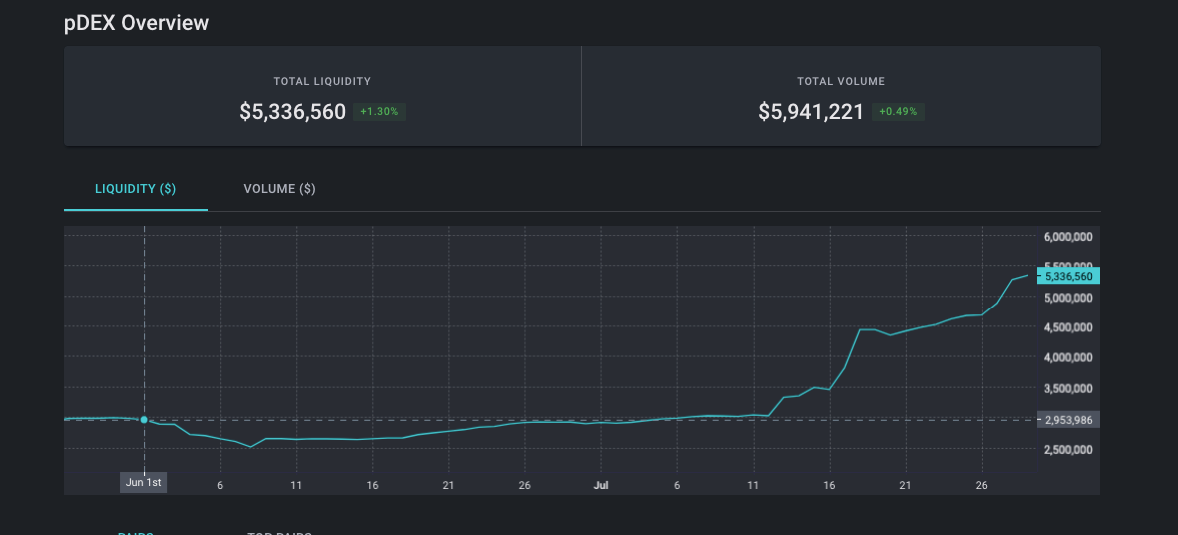

No honey no liqudity

Will there be a way to see all available pairs when completing a trade? Right now it seems to display the best price/ best liquidity option automatically.

Will there be a way to see all available pairs when completing a trade? Right now it seems to display the best price/ best liquidity option automatically.