Hey Guys,

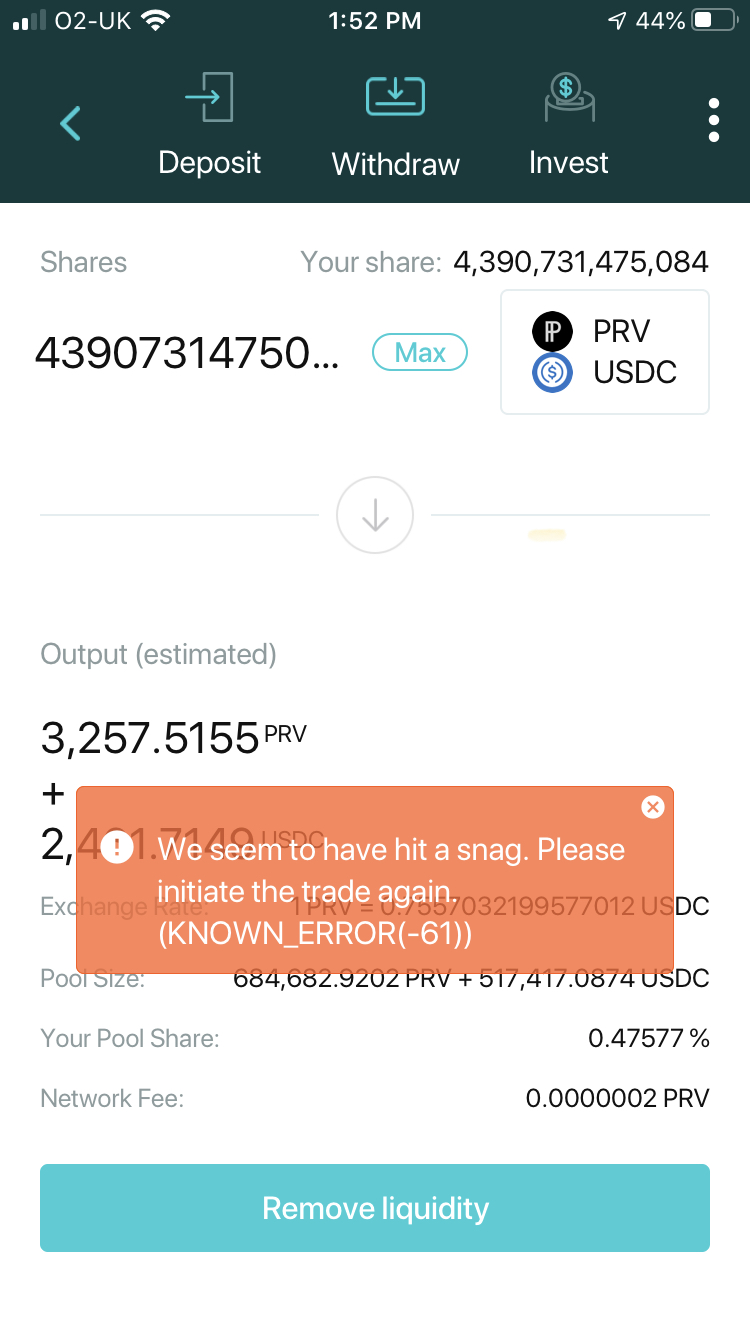

I’ve been keeping up on this thread, and the communication has been great. A lot of great ideas have been put out there. You guys can take this for what it’s worth, but I thought I’d add my two cents from the little guys perspective. First and foremost, I am a firm believer in privacy rights. This extends far beyond crypto trading for me. When I first heard of the incognito project last year, I bought a node. I didn’t know much about anything from the platform side of crypto trading. I just dabbled with actual trading. However, the idea of the project seemed to match my values, and the process seemed simple enough to take a gamble on the ground floor of things. Buy a device, plug it in, make your money back in a year. I didn’t do much research, or anything for that matter, for the next few months. I just plugged it in and left it. Which, while I realize is not the best idea, is what I would assume anyone who knows nothing about this world would do. I feel like that is actually the market that was being targeted with a plug and play device. In the last few months though, I decided to become more invested in the community. I started reading through the threads, and I started having a better idea of the project. I looked at the rates, and thought I had a simple, but firm, grasp on what was going on. I bought two more nodes, and I decided I was going to invest some more money. I was going to see this through for at least the next year. My app told me what the investment rates would be for the next year, so naturally I believed that. I also talked to someone else who has investments all over. I made my pitch to him and his response was, “I trust you to do your research. So, I’ll invest.” This is a statement I don’t take lightly. However, I’ve been moving money in as this switch over has happened, and I’m as shook as anyone else about some things that have come to light. Yes, buried in a thread is a statement that rates may change. No, I did not know that my rates would change based on liquidity. I opened the investment tab on the app, and it just showed me APRs, so those are the numbers I was going on. Furthemore, I was looking for a way to track my investment, and the best I could find was a thread that basically said “Pretend like you’re pulling your money out, so you can see what you actually have.” This didn’t feel like a sound way for me to track my investment. More importantly, an investment given to me by someone else. I want to have answers if he has questions. So, I dove into the Incognito Network Explorer and basically taught myself javascripting just to be able to pull the data I needed into a google sheet. While I like to nerd out on stuff like that, it is not doing any average investor any favors by not knowing what is going on with their money in real time. I can pull realtime PRV pricing, overall liquidity per pair, and volume. But, as of now, I am still stuck though. The apr rates are different for each side of the pair, and I cant pull that latest data. So, I still can’t really track my investment the way I need to. It has been updated to say 55K to liquidity providers. But is that split between all pairs? 55k per pair? It doesn’t tell me that. I feel like going that far to get real numbers and still coming up short is a red flag that the investment side of this isnt as thought out as I originally believed. Even the calculators I’ve found are basic at best. They aren’t, in any way, a representation of what you would actually make when you invest. While I still have my money on the platform, I am basically in a holding pattern. While he and I both understand risk in any investment, I am not willing to put anyone’s money into something I don’t have a firm grasp on. Like I said, just my two cents. I feel like the conversation overall is heading in the right direction despite the network hemorrhaging since June 1st. If anyone is interested. Here is the spreadsheet I’ve been working on with some random sample data. Tracks real time PRV price, staking rewards, and latest crypto pricing as of now. I have the investment part done as I currently understand rewards to be calculated based on this post, but I will finish working on the investment part once this gets sorted out. Will be adding ROI too.