The LP program is moved to -> Pool

The last LP reward happened on Monday, July 13.

If you would like to contribute to the liquidity pools on Incognito DEX, please do it through Pool.

##Provide liquidity. Provide privacy.

pDEX is the only exchange that protects user privacy, but without liquidity, what Incognito can do is limited. More liquidity = more privacy, for more people. It’s that simple.

Provide liquidity to pDEX. Put your PRV where it matters.

Earn rewards on any PRV pair

The beloved liquidity rewards program just got an upgrade. As the world’s privacy currency, PRV makes completely anonymous trades of any cryptocurrency possible.

So from June 1, 2020, you’ll earn rewards on every PRV pair.

How do I become a liquidity provider?

All you need to do is provide even liquidity to both sides of the pair – say PRV and BTC. For example – if you want to contribute $20,000 in liquidity, you’d have to contribute $10,000 of PRV and $10,000 of BTC.

Click here to expand instructions

1. Open your Incognito wallet to access the Invest

Don’t have a wallet yet?

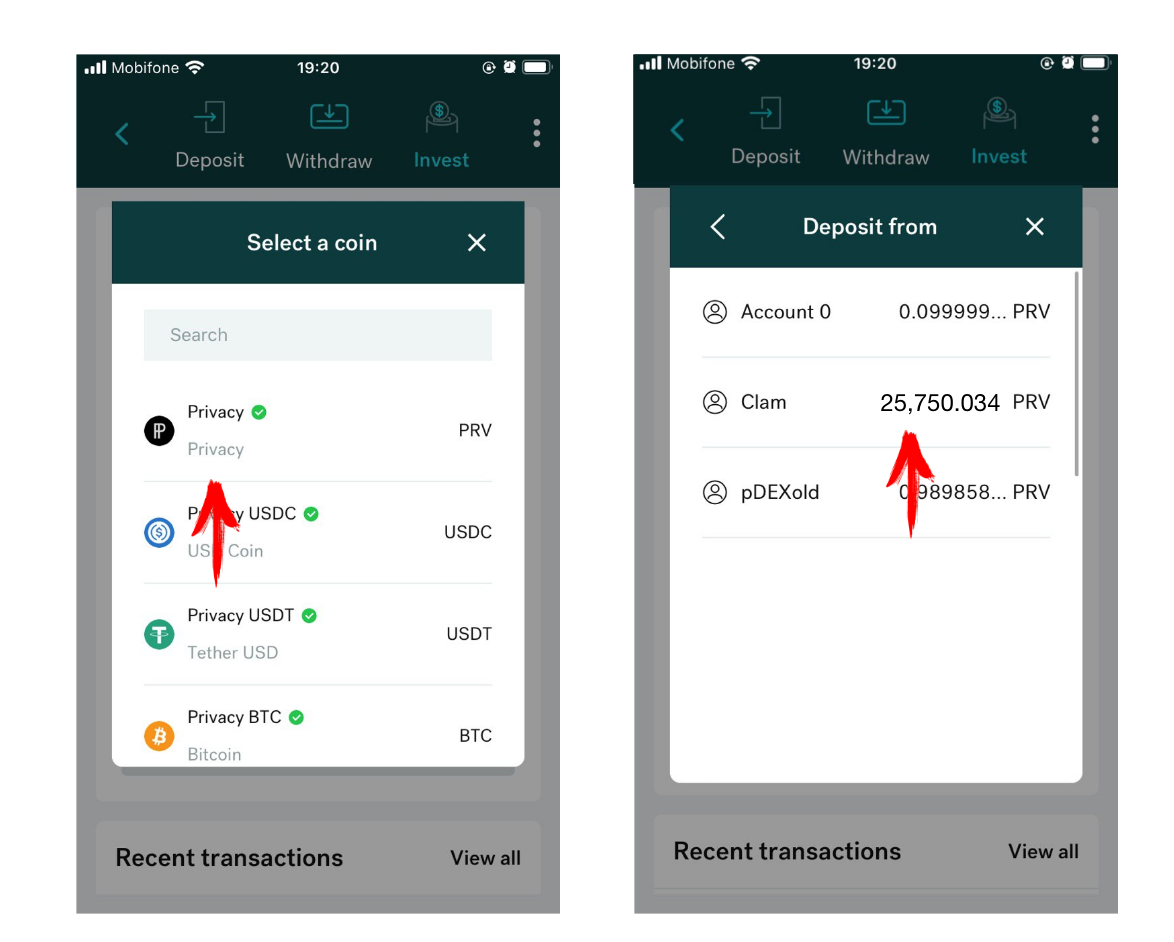

2. Deposit funds to your trading account

On your home screen, tap the ‘Provide’ icon. This will open up the Provide.

Then tap deposit.

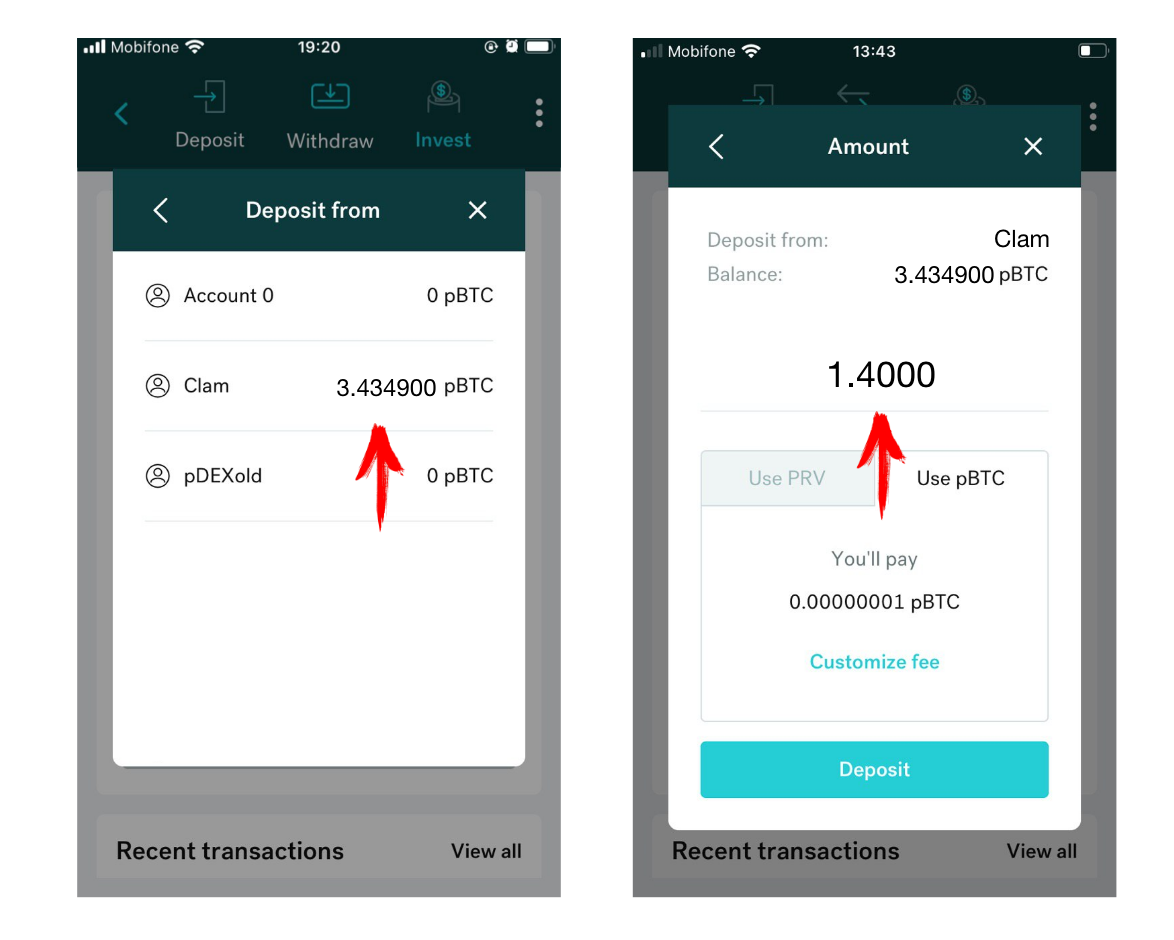

Next, choose which account you’d like to deposit funds from.

Select the account, enter the amount, and tap Deposit.

Do it for the second token too (in our case its BTC, in your case can be any)

That’s it. Now you have funds in your trading account.

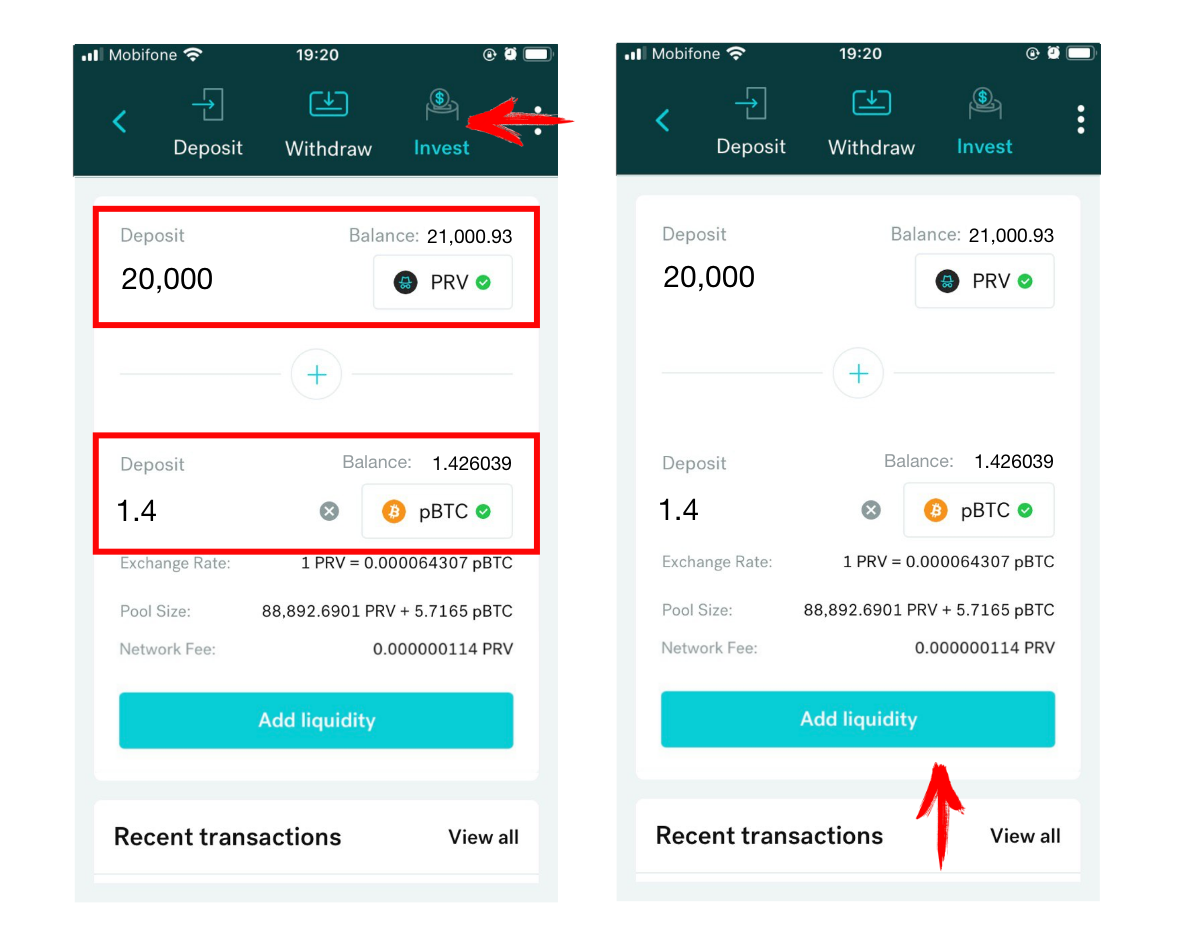

3. Add liquidity from your trading funds

Tap ‘Invest’ at the top of your screen, and set the amount you want to provide. Then tap ‘Add liquidity’ at the bottom of your screen.

Double-check both Tokens and Amounts you are going to add liquidity for.

Success!

From the minute your liquidity contribution is made, you’ll start earning rewards. Rewards will be automatically deposited to your pDEX account every Monday.

Thanks for being a liquidity provider!

Program details

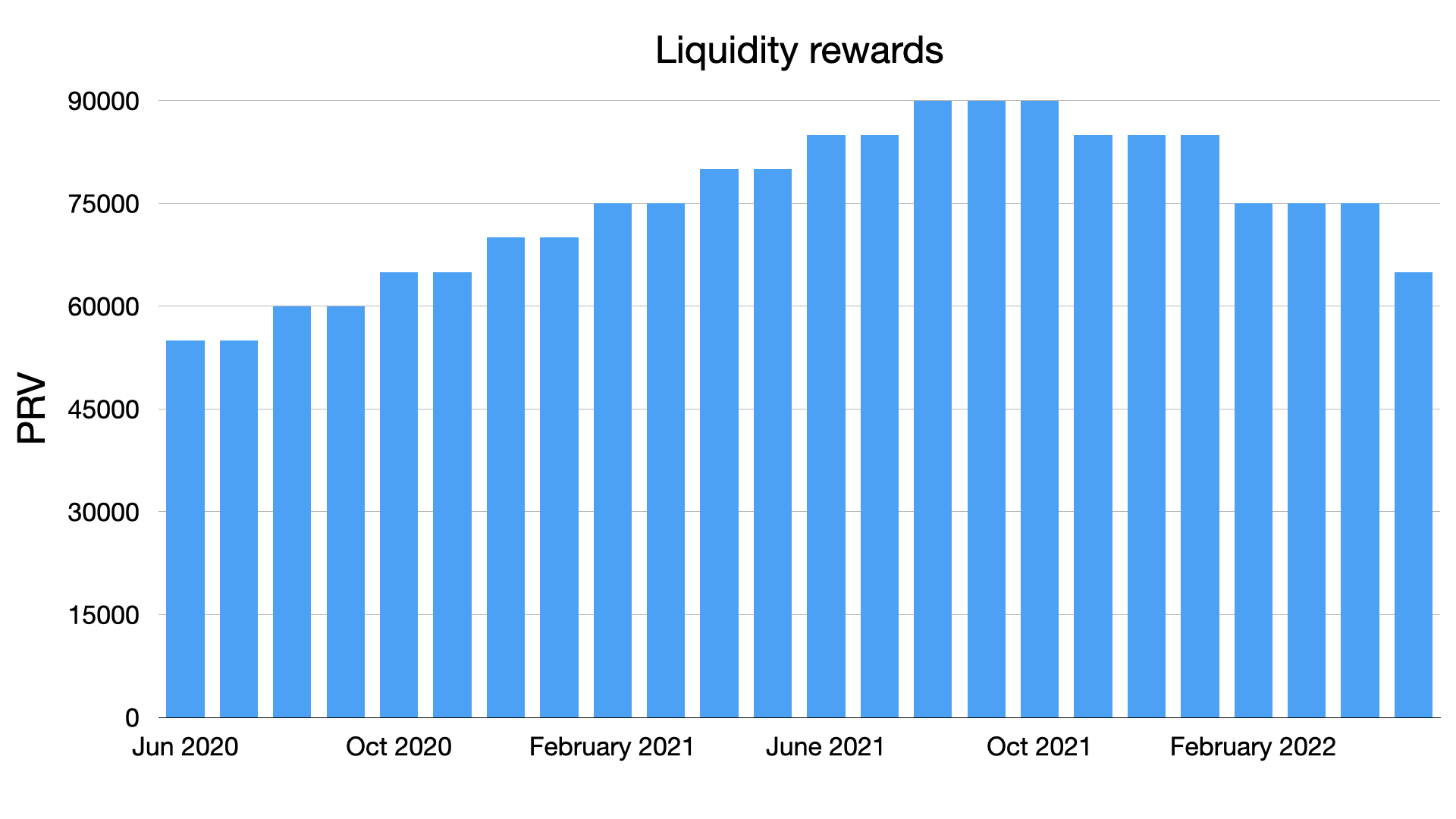

Starting June 1, 2020, this is how liquidity rewards will be calculated:

- Fixed rewards pool every month

- Every PRV in any liquidity pool qualifies for rewards

- Distribution continues every Monday 08:00 UTC (until Invest v2 is live)

The following diagram shows the estimated distribution of rewards over the coming months.

Want to estimate your ROI? Play with numbers here.

Figures above are dependent on demand. Rewards may increase or decrease according to the amount of funds in liquidity pools.

Here’s how to calculate your rewards

Let’s say you’ve contributed 10,000 PRV and equivalent in 6,700 USDT into liquidity pools. Total PRV in liquidity pools are 2,000,000 PRV

In June, 55,000 PRV will be distributed to liquidity providers. That’s you! Your contribution is 1/200 (10,000/2,000,000) of the total pool.

June reward = 55,000 PRV/$2,000,000 * 10,000 = 275 PRV

Let’s take a broader look.

| Month | Estimated reward (PRV) | Estimated reward (USD) | Estimated APR (PRV only) | Estimated APR (whole pair) |

|---|---|---|---|---|

| June | 275.0 | $184.25 | 33.00% | 16.50% |

| July | 275.0 | $184.25 | 33.00% | 16.50% |

| August | 300.0 | $201.00 | 36.00% | 18.00% |

| September | 300.0 | $201.00 | 36.00% | 18.00% |

| October | 325.0 | $217.75 | 39.00% | 19.50% |

Rewards are paid out from the Incognito DAO, a self-sustaining organization dedicated to funding development of the Incognito ecosystem.

Ready to start earning rewards?

Just open pDEX from your Incognito app.

FAQ

What is the pDEX?

pDEX is the first completely private decentralized exchange. Powered by an automated market making mechanism.

What is the minimum or maximum amount of liquidity I can provide?

There are no restrictions. You can provide any amount of liquidity.

What is the lock-up period?

There isn’t any. You can withdraw your liquidity contribution at any time.

How often and how will I get my rewards?

Reward will be automatically distributed every Monday to your pDEX account. Note that if you remove liquidity on a different day, you will be paid on the following Monday.

How is the reward calculated?

Your rewards are calculated based on the amount of liquidity contributed, and the length of time your funds are in the pool.

Which currencies will I get paid in?

All rewards will be paid in PRV based on the pDEX market rate on the day of distribution.

For example, let’s say your reward is 8 USDT. The equivalent amount in PRV will be taken from the USDT/PRV pair on pDEX. So if PRV price on the distribution day is $0.45, you will get 17.7 PRV.

How can I check my liquidity balances ?

We work on building a proper dashboard for liquidity providers, meanwhile here is guide how you can check your liquidity balances.

When I use my private keys and restore my accounts, do I restore liquidity also?

Yes. When you restore your wallet from different device you will get access to your liquidity pools.

If you have any further questions, feel free to post a reply to this topic, or DM @andrey