Yep, reward was distributed yesterday.

Could you please DM with details TX of adding liquidity, I’ll check the reward dashboard.

Yep, reward was distributed yesterday.

Could you please DM with details TX of adding liquidity, I’ll check the reward dashboard.

Hey @andrey, do you think about rewarding also PRV <> pBNB (in Binance Chain, since its withdrawal fee is much less) pair? CZ always promotes BNB-related campaigns in his Twitter account. He previously promoted Aave campaign, now Kava.

P.S.: There are two pBNBs (one for Binance chain, one for Ethereum chain) in Incognito chain. I think this is confusing and will make liquidity management in pDEX difficult for pBNB pairs. If possible, merging them into the single pBNB would be better.

How or where will we see the status of our pairs earning?

Also any chance we will see ADA in pDex?

Thanks

Hey @Z3Y,

Yep, the devs team work on building the dashboard for liquidity providers. It allows to track and withdraw earnings in real time.

We expect to have the dashboard next week

Regarding adding ADA.

I have a chance to talk with Rob Cohen form IOHK, he said that make sense to raise this question to cardano community only when they launch own smart-contracts platform.

Probably we should push this question to cardano community https://forum.cardano.org/ I believe as bigger discussion will be around this as faster we can integrate it )

Hi @andrey

I’ve provided liquidity and see coins changing from one side to the other, so when I want to revoke the liquidity, I assume I have to take the rate they’re representing on that moment?

Could you also explain how things work when someone exchanges a pUsdc to a pBtc token, specially when one wants to initiate a withdrawal.

How does the swap occur behind the scenes? I just have to wait untill the real btc is confirmed to withdrawal, or how does settlement work?

I see you are in the ren alliance, how are you working together?

Hi @4ManDown very good questions. @nickvasilich here is also partly answer on your questions.

Yep, that’s correct. When the trades happen forth and back the balance of liquidity pools changed after each trade, which change balance all liquidity providers accordingly to their pool share.

For example: if you put 1000 pUSDT and 2000 PRV and someone bought 500 PRV. The pools balance will be 1250 pUSDT and 1500 PRV.

If you decided to withdraw exactly the same moment you will get 1250 pUSDT + 1500 PRV + trading fee happened on this pool while your liquidity were there.

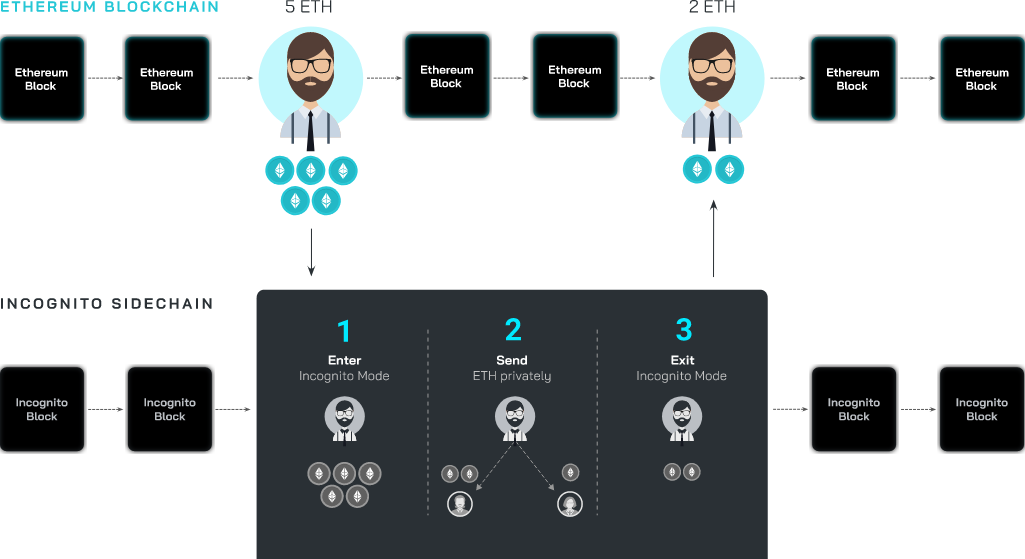

Firstly - Chain

All trades which happens on pDEX they are happening on Incognito Chain and do not require confirmation on Bitcoin or ethereum blockchains.

As you can see in this image Incognito chain blocks confirms in parallel to the main chain.

The pDEX technology based on Automated market making algorithm.

In simple words it means that on back end set up fixed algorithm for all liquidity pools, when

poolA * poolB = Constant

It means, when you buy or sell, you change the quantity of tokens in each pool, which affect the token price accordingly.

Example

Let’s take the same data as before. Initial pool is 1000 pUSDT & 2000 PRV. Which means 1 PRV ≈ 0.5 pUSDT.

When someone bough 500 PRV. The pools size changes. Now its 1250 pUSDT & 1500 PRV. With such pools 1 PRV ≈ 0.83 pUSDT.

This algorithm is the same for all liquidity pools on pDEX. If you are interesting to understand deeper from technical perspective how it works, please check this publication: pDEX: The first privacy-protecting decentralized exchange

We integrated REN token to Incognito Wallet, which allows users shield transfer and trade REN confidentially. Hopefully will do something bigger in near future.

@4ManDown hopefully I answered on your questions, but feel free to ping me if any clarification is needed.

Is something wrong with the network?? I now got 2 of my deposits stocked🤦

@andrey Just curious how often are the funds we add to liquidity compounded?

I noticed the pool stake (pStake) was compounded every second (read continuously) is this also the case for the liquidity pool?

Hi @Jared

The staking APR of 57% is already compounded calculation while pDEX liquidity reward is not compounded yet.

On this moment we still working on the pDEX liquidity reward dashboard and functionality. Approximately it will take around 3-4 weeks to finalize everything.

If I want to issue a pVersion of an existing coin but I don’t want to fill my address etc to get the verified status what are consequences, for example if I add much liquidity to this pair?

Hey @4ManDown, no consequences. The pDEX is permissionless decentralized exchange, which means anyone can add any pair and power with any liquidity

You can create own privacy coin on Incognito chain or add any token from ethereum or binance chains and add liquidity on the same way.

@andrey Not sure if you are the creator of this Google sheet or not (I can’t seem to find the original article about it). Can you use the protected cells function of Google Sheets to lock the parts others do not need to modify? I fear a bad actor could come and mess with the information that is used to make the calculator function properly.

All cells of the table can be locked besides B3 & B8.

Edit: Looking at the calculator it is apparent that unwanted changes were already made, whether intentionally or unintentionally now the cells need to be fixed and locked.

@Rick_Shah is the creator of spreadsheet calculator. @Rick_Shah what do you think about to fix the cells somehow ?

I provided some liquidity to the PRV/BTC pair a few weeks back. I have received PRV in my wallet but I didn’t notice any BTC.

I also noticed the PRV I earned is not listed in the transactions for my PDEX wallet. Is that something that will be added?

Hey @Kelsomatic, unfortunately we can pay pDEX rewards in PRV only. The percentage is calculated in both coins, but on the day of distribution all convert in PRV and distributed tho the providers.

Despite this you are fee to swap your PRV to ETH or BTC right away you receive the rewards.

You mean the reward incoming transaction ? It’s just because the pDEX wallet is designed in this way. The process will be change a bit once we release new UI for pDEX. The reward calculation will be similar to Staking app.

I locked the cells. I will go back and see if anyone made changes they weren’t supposed to when the cells were unlocked.

Thank you Andrey. I prefer the earnings in PRV so it works out better for me this way.

Hi @Jared, thanks for catching the unwanted changes. I updated the sheet and it is locked. Let me know if you have any other questions.

Hi. A really interesting question was posted in the Telegram group, by Corey Clark, and it goes like this:

Help me with this… If you have $2K to invest, and do it in liquidity, you would have $1K worth PRV and $1K worth of USDT… the 67% on PRV would return $670, and $80 for USDT, for a total return of $750.

But if you took that full $2K and turned into PRV and staked for 57%, wouldn’t that be $1,140?

So in this case, wouldn’t 57% of $2K be better than splitting that up into liquidity pool?

I do understand the differentination on risk, where PRV value can go up or down, and USDT is stablecoin, but looking at pure return… wouldn’t staking be higher?