Automated market making

Incognito DEX is powered by an Automated Market-Making ( AMM ) algorithm.

AMMs allow users to swap crypto assets, for example DAI for PRV, without requiring a centralized counterparty. This is unlike traditional exchanges such as Coinbase, Kraken, or Binance, which act as intermediaries between token buyers and sellers.

While these companies are centralized, and subject to regulations, censorship and identity control, AMMs are simply smart-contract systems operating unstoppably on top of distributed ledgers such as Incognito & Ethereum.

One of the most important qualities of AMMs is that they require some users to act as the liquidity providers in the service. Liquidity providers commit their own asset pairs to so-called “liquidity pools”.

When using Incognito DEX and swapping PRV for DAI for example, you are trading your assets against one of these liquidity pools.

Fee structure in liquidity pools

Typical AMMs like Uniswap charge a certain transaction fee to the users of the service. These are added to the liquidity pool, and distributed among users who committed funds to it, proportional to their contribution.

In the case of Incognito DEX, the trading fee is 0.0%. The main reward for the liquidity providers comes from a rewards program.

[EDIT: this program has been discontinued in favor of the Provide feature]

Impermanent loss

When contributing both sides of a pair, users who provide liquidity to AMMs can see their locked tokens change value compared to simply holding the tokens on their own. Most people don’t really understand how and why impermanent loss occurs.

What is impermanent loss?

Impermanent loss is the main difference between holding tokens in an AMM and holding them in your wallet. It occurs when the price of tokens inside an AMM diverge in any direction. The more divergence, the greater the impermanent loss.

Why “impermanent”?

Because as long as the relative prices of tokens in the AMM return to their original state when you entered the AMM, the loss disappears and you earn 100% of the trading fees + 100% of subsidized rewards.

How does it occur?

To understand how impermanent loss occurs, we first need to understand how AMM pricing works and the role arbitrageurs play.

In their raw form, AMMs are disconnected from external markets. If token prices change on external markets, an AMM doesn’t automatically adjust its prices. It requires an arbitrageur to come along and buy the underpriced asset or sell the overpriced asset until prices offered by the AMM match external markets.

During this process, the profit extracted by arbitrageurs is effectively removed from the pockets of liquidity providers, resulting in impermanent loss.

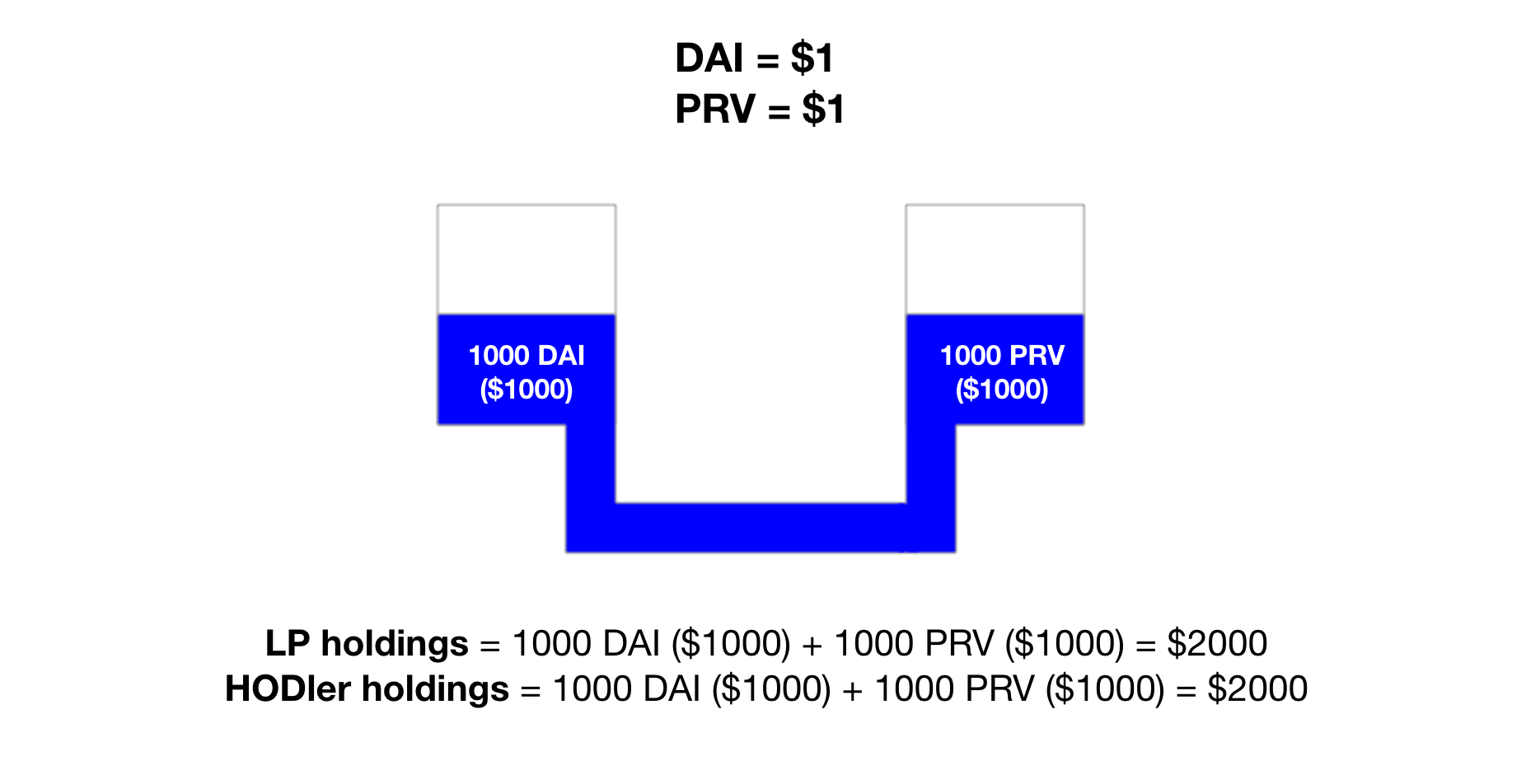

For example, consider an AMM with two assets, PRV and DAI, set at a 50/50 ratio. As shown below, a change in the price of PRV opens an opportunity for arbitrageurs to profit at the expense of liquidity providers.

- The DAI/PRV AMM is balanced, with equal values on both sides

-

The price of PRV increases by 10%, creating an arbitrage opportunity.

-

Arbitrageurs are incentivized to balance AMM by selling DAI for PRV, until both sides of the AMM are equal.

-

As a result, liquidity providers suffer a - $2.4 loss compare to holding PRV & DAI

What’s the motivation to become a liquidity provider?

During April and May, we experimented with the first Incognito DEX rewards program which paid interest to cover any potential loss, but also required users to contribute both sides of the pair. This proved to be confusing and unwieldy.

So in June, we improved on the original program by implementing a new app feature named Provide. Provide allows users to contribute single currencies, and is designed to ensure that the original provision never changes, that earnings are steady and transparent, and that providers are protected from impermanent loss.

Please note that the Add feature (two-sided liquidity) is no longer interest-earning, and will be revised later this year with a new incentives feature.

Further reading

- https://incognito.org/t/incognito-dex/337

- https://incognito.org/t/supply-liquidity-for-incognito-dex-provide-privacy-for-the-world/1406

Resources: